How to Use a Business Loan to Grow Your Company (Without the Risk)

For ambitious business owners, growth isn't just a goal; it's a constant pursuit. Yet, the path from stability to accelerated expansion is often paved with significant financial requirements. While the idea of taking on debt can be daunting, a business loan, when viewed not as a liability but as a strategic asset, becomes one of the most powerful catalysts for scaling a company. The need for external funding is common; in 2023, 59% of small businesses with employees applied for a loan. The difference between those who merely survive and those who thrive lies in leveraging that capital with precision and foresight.

This article moves beyond the basics of borrowing. It provides a strategic framework for transforming a business loan into an engine for accelerated growth, guiding you through the critical phases of planning, allocation, acquisition, and long-term management to maximize your return on investment.

Introduction: Beyond Borrowing – Embracing Strategic Debt for Growth

The Evolution of Business Loans: From Necessity to Strategic Asset

Historically, many small business owners sought loans out of necessity—to cover payroll during a slow season or manage unexpected expenses. This reactive approach positioned debt as a lifeline. Today, the mindset has shifted. Successful business owners now see loans as a proactive tool for creating opportunities. A small business loan is no longer just about survival; it’s about strategically deploying capital to outpace competitors, innovate faster, and capture market share. This evolution reframes debt from a financial burden into a calculated investment in your company's future profits and long-term value.

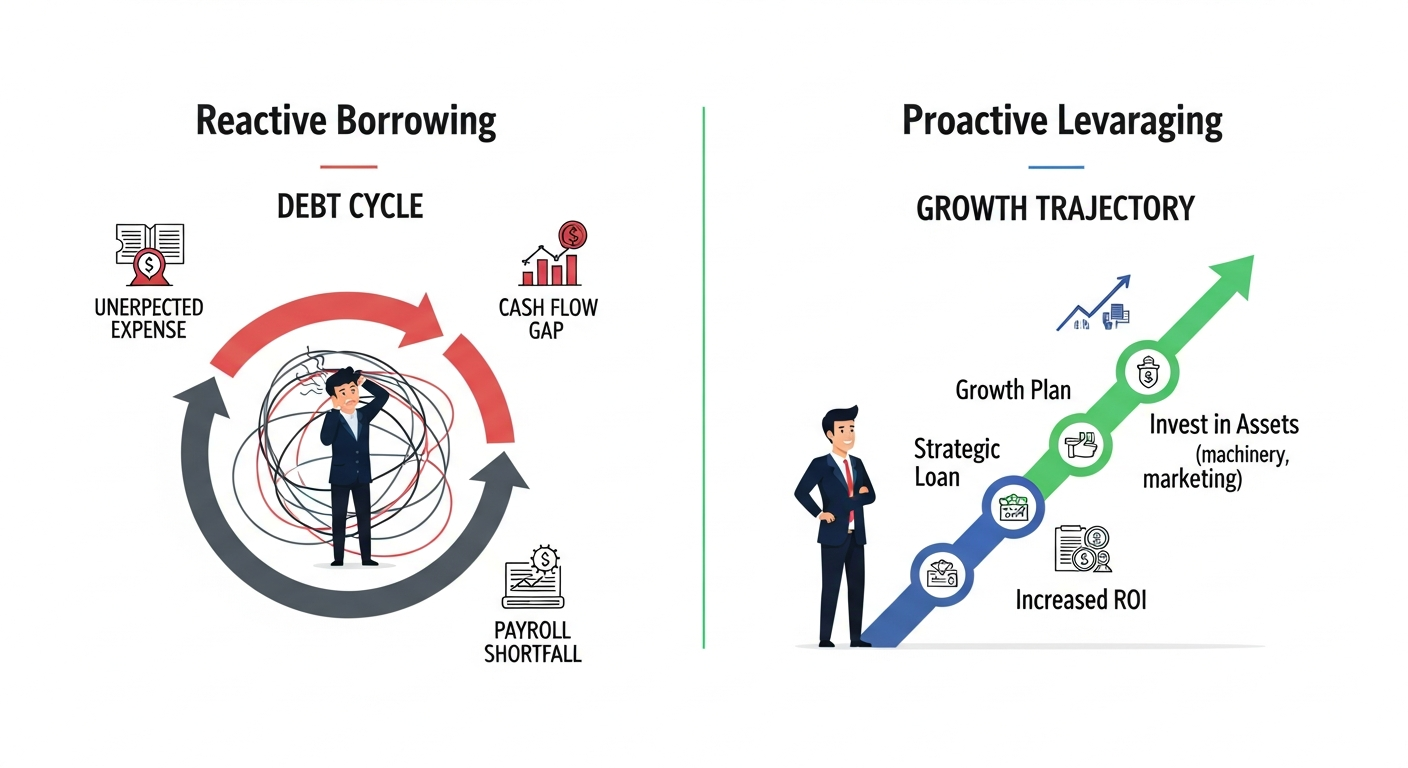

Differentiating Reactive Borrowing from Proactive, Strategic Leveraging

Reactive borrowing plugs holes, often leading to a debt cycle. Proactive leveraging uses a loan as fuel for a planned growth trajectory.

Reactive borrowing plugs holes in your cash flow. It’s a short-term fix for an immediate problem, often done under pressure and without a clear plan for how the funds will generate future revenue. This can lead to a cycle of debt where a business is constantly trying to catch up.

Proactive, strategic leveraging is fundamentally different. It begins with a clear growth objective and a detailed plan for how injected capital will achieve it. Every dollar is allocated to an initiative with a measurable return on investment (ROI). This approach uses funds to build scalable systems, invest in revenue-generating assets, and expand operations in a way that creates sustainable, long-term growth.

Phase 1: Defining Your Accelerated Growth Strategy Before the Loan

Before approaching any lenders, the most critical work happens internally. A loan without a strategy is just money; a loan with a strategy is fuel.

Clearly Identify Your Specific Growth Objectives

Vague goals like "grow the business" are insufficient. Your objectives must be specific and actionable. Are you aiming to increase production capacity by 50%? Do you want to launch a new product line within 12 months? Is your goal to expand into three new geographic markets? Or do you need to hire a specialized sales team to increase customer acquisition by 30%? Each of these specific objectives points toward a different use of capital and dictates the type and amount of funding you need.

Quantify Your Growth Targets: What Does "Accelerated" Mean for Your Business?

"Accelerated" is a relative term. You must define what it means for your specific business. Look at your historical growth rate. If you've been growing at 10% annually, an accelerated target might be 25% or 30%. Quantifying your targets transforms an abstract goal into a concrete benchmark. This allows you to build financial projections that demonstrate to lenders exactly how their capital will create this jump in performance and, more importantly, how you will generate the revenue to service the debt and increase profits.

Analyze Your Current Business Health, Market Position, and Untapped Potential

A strategic loan amplifies what is already working. Conduct a thorough analysis of your business. What are your core strengths? Where are your operational bottlenecks? What market trends can you capitalize on? An honest assessment of your current state reveals the areas where an injection of funds will have the most significant impact. Perhaps your product is superior, but your marketing is weak. Or maybe demand is high, but your outdated equipment can't keep up. Identifying these specific leverage points is crucial.

Crafting a Growth Strategy that Pinpoints Where Capital Can Accelerate Progress

With clear objectives and a solid analysis, you can build a growth strategy. This roadmap should detail the exact initiatives you will fund. It’s not just about listing expenses; it's about creating a narrative. For example: "We will allocate $50,000 to purchase a new CNC machine (equipment), which will increase our production efficiency by 40%, allowing us to fulfill larger orders and increase annual revenue by an estimated $150,000." This narrative directly links the capital to a specific, measurable outcome.

Phase 2: Strategic Loan Allocation – Matching Capital to Growth Initiatives

Once your strategy is defined, the next step is to earmark the loan funds for specific, high-impact initiatives. This ensures every dollar is put to work driving growth. A recent Forbes Advisor survey found that 42.4% of business owners used their latest loan for business expansion, underscoring this as a primary strategic use of capital.

Investing in Core Operations for Scalability and Efficiency

Growth often breaks inefficient systems. Using a business loan to upgrade your core operations is an investment in scalability. This could mean implementing new software to automate workflows, upgrading manufacturing equipment to increase output, or optimizing your supply chain to reduce costs. These improvements don't just help you manage current demand; they build the capacity to handle future growth without collapsing under the weight of new business.

Fueling Market Expansion and Customer Acquisition

Capital can be the primary accelerant for reaching new customers. Loan funds can be strategically allocated to robust marketing campaigns, building a high-performing sales team, or establishing a presence in new territories. Whether it's digital advertising, content marketing, or opening a new retail location, investing in customer acquisition directly fuels top-line revenue growth, which is essential for both repaying the loan and boosting profits.

Human Capital Investment for Enhanced Performance and Innovation

Your team is one of your most valuable assets. A loan can be used to invest in human capital by hiring key personnel with specialized skills you currently lack, such as a Chief Technology Officer or a seasoned marketing director. It can also fund training and development programs for your existing staff, increasing their productivity and capacity for innovation. A stronger, more skilled team is better equipped to execute your growth strategy effectively.

Acquiring Strategic Assets for Competitive Advantage

Sometimes, the fastest path to growth is through acquisition. This could involve purchasing new equipment that gives you a technological edge, acquiring a smaller competitor to gain market share and talent, or buying commercial real-all estate to stabilize overhead costs and build equity. These strategic assets can provide a significant and lasting competitive advantage.

Refinancing for Growth Capital, Not Just Cost Reduction

Many business owners think of refinancing existing debt solely as a way to lower their interest rate. However, a strategic refinance can also unlock trapped equity or consolidate payments to free up cash flow. This newly available working capital can then be deployed into the growth initiatives outlined above, turning a defensive financial move into an offensive one.

Phase 3: Navigating the Strategic Loan Acquisition Process

With a clear strategy and allocation plan, you are prepared to engage with lenders. This phase is about presenting your vision in a way that inspires confidence and secures the right financial partnership.

Crafting a Growth-Focused Business Plan and Robust Financial Projections

Your loan application is more than a request for money; it's a business case for growth. Your business plan must clearly articulate your objectives, your strategy for achieving them, and how the loan fits into that picture. Most importantly, your financial projections—income statements, cash flow statements, and balance sheets—must demonstrate a clear, data-backed path from loan disbursement to increased revenue and profitability.

Building a Strong Financial Profile and Creditworthiness

Lenders assess risk. A strong financial profile is your best tool for mitigating their concerns. This means maintaining a healthy business credit score, managing existing debt responsibly, and ensuring your financial records are clean and organized. Proactively addressing any weaknesses in your financial profile before applying for a loan will significantly increase your chances of approval and help you secure a more favorable interest rate.

Exploring Diverse Loan Programs and Lenders for Strategic Fit

Not all loans are created equal. An SBA 7(a) loan might be perfect for acquiring real estate, while a line of credit is better suited for managing working capital during a period of rapid expansion. Research different options, including traditional banks, credit unions, and online lenders. Smaller community banks, for instance, often have higher approval rates; small banks approved 75% of applicants for at least some financing in 2023, compared to 66% at large banks. Finding a lender who understands your industry and growth vision can be just as important as securing a low interest rate.

Preparing for the Loan Application Process and Due Diligence

The loan application process requires meticulous documentation. Gather all necessary paperwork in advance, including financial statements, tax returns, bank statements, and legal documents. Be prepared for the lender's due diligence process, where they will scrutinize every aspect of your business. A well-organized, transparent, and responsive approach will streamline the process and build trust with the lender.

Phase 4: Maximizing ROI and Sustaining Accelerated Growth Post-Loan

Securing the loan is a milestone, not the finish line. The final phase is about diligent execution, monitoring, and management to ensure the capital delivers on its promise of accelerated growth.

Implementing a Robust Monitoring and Tracking System

You must track the performance of your growth initiatives against the projections you made. Establish key performance indicators (KPIs) for each area of investment. For a marketing campaign, this might be customer acquisition cost and conversion rates. For new equipment, it could be production output and unit cost. Regularly reviewing these metrics will tell you whether your strategy is working or if you need to make adjustments.

Agile Management and Contingency Planning

Markets change, and even the best-laid plans can encounter obstacles. Agile management means being ready to pivot. If one marketing channel isn't delivering ROI, be prepared to reallocate those funds to one that is. Have contingency plans in place. What if sales growth is slower than projected? How will you manage cash flow? Being proactive about potential challenges prevents them from derailing your entire growth trajectory.

Strategic Debt Management and Future Capital Planning

Managing your new debt obligation is paramount. Ensure your repayment schedule is integrated into your budget and cash flow projections. Making timely payments is crucial for maintaining a strong credit profile. It's also important to note that many businesses carry significant debt as part of their capital structure; 39% of small businesses carry debt over $100,000. Successfully managing this loan not only fuels current growth but also builds a track record that makes it easier to secure future capital for the next stage of your business evolution.

Conclusion: Your Loan as a Catalyst for Continuous Growth

Reiterate the Business Loan as a Strategic Asset, Not Just a Financial Tool

A business loan should never be viewed as simply filling a financial gap. It is a powerful instrument of strategy—a tool to be wielded with precision to build a more efficient, expansive, and profitable enterprise. By shifting your mindset from reactive borrowing to proactive investment, you unlock its true potential as a catalyst for growth.

Emphasize the Importance of a Clear Growth Strategy, Meticulous Planning, and Ongoing Performance Measurement

The success of any business loan is determined long before the funds ever hit your account. It is rooted in a clear and quantifiable growth strategy, meticulous financial planning, and a disciplined commitment to measuring performance. Without this framework, capital is just cash; with it, capital becomes a strategic advantage.

Empowering Business Owners to Leverage Debt Proactively for Long-Term, Accelerated Success

Ultimately, leveraging a business loan for accelerated growth is an exercise in foresight and execution. By defining your objectives, strategically allocating funds, and diligently managing both your initiatives and your debt, you can transform a loan from a simple transaction into a pivotal moment in your company's history—the moment you deliberately chose to accelerate toward a more successful future.

Ready to break free from the limits of bootstrapping?

Apply for a business loan today and see how BOSS can help you grow faster—with expert coaching to guide you every step of the way.