Cash vs Loans: How to Fund Your Business Growth the Smart Way

Introduction: Fueling Growth – The Core Financial Dilemma

For any ambitious company, growth isn't just a goal; it's a necessity for survival and success in a competitive market. Fueling that growth, however, presents a fundamental financial dilemma that every business owner must confront: should you use the cash you have on hand, or should you take on debt through a loan? This choice is far more than a simple accounting decision—it's a strategic pivot that can define the pace, scale, and sustainability of your expansion.

The Ever-Present Challenge for Business Owners

Business owners are constantly juggling the need to invest in the future with the demands of the present. The capital required for a new marketing campaign, purchasing essential equipment, or expanding inventory often exceeds readily available cash. This creates a critical decision point where the path chosen can either unlock rapid progress or introduce unforeseen risks to the company’s financial health.

Why Strategic Capital Decisions Are Crucial for Business Growth

Making the right capital decision is the difference between seizing an opportunity and watching it pass by. A well-timed loan can provide the leverage needed to outpace competitors, while a disciplined, cash-based approach can ensure stability and resilience. An impulsive or ill-informed choice can strain cash flow, jeopardize operations, and turn a promising growth initiative into a liability. The stakes are high, and the strategy matters.

A Glimpse into the Decision Framework: Beyond Simple Choices

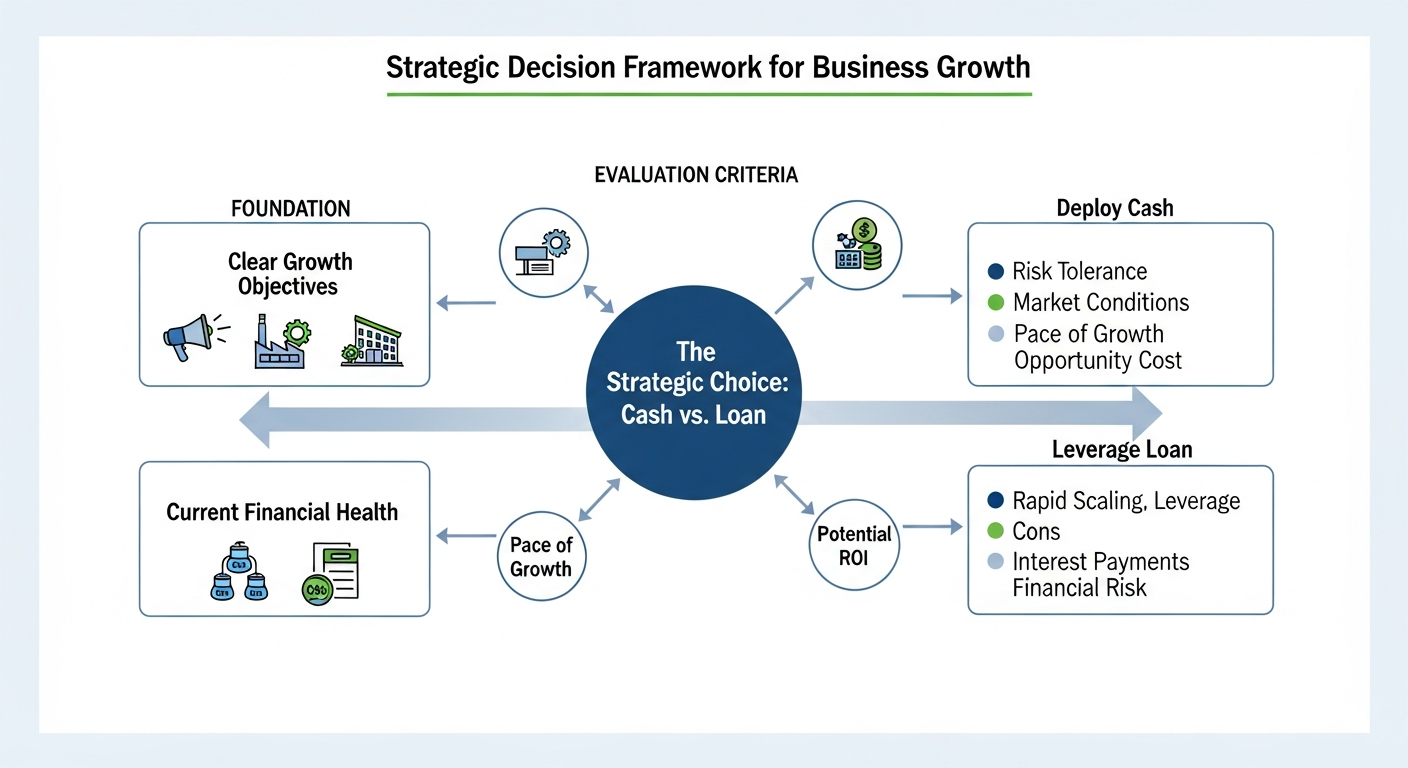

The Strategic Decision Framework considers your business goals and financial health to evaluate whether using cash or taking a loan is the right choice for growth.

This article moves beyond the simplistic "debt is bad, cash is good" debate. Instead, it provides a strategic decision framework designed to help business owners evaluate their specific situation. We will analyze when to deploy cash, when to leverage debt financing, and how to make an informed choice that aligns with your unique growth ambitions, risk tolerance, and market conditions.

Laying the Foundation: Understanding Your Business Growth Ambitions

Before weighing the pros and cons of cash versus loans, you must first establish a clear and solid foundation. Your financing strategy should be a direct reflection of your business goals and its current reality. Without this clarity, any decision is just a guess.

Defining Clear Growth Objectives

What does "growth" actually mean for your business? The answer dictates the type and amount of capital you need. Are you aiming to:

Increase market share by launching an aggressive marketing campaign?

Improve efficiency by investing in new equipment or technology?

Expand your product line or increase inventory to meet customer demand?

Enter a new geographical market through physical or digital expansion?

Each objective has a different price tag, timeline, and potential return on investment. Defining these goals with precision is the first step toward building a sound financial strategy.

Assessing Current Financial Health and Capacity

A brutally honest assessment of your company's finances is non-negotiable. Key metrics to analyze include your current cash flow, profit margins, existing debt levels, and the overall stability of your revenue streams. Strong, predictable cash flow might support gradual, self-funded growth or make your business an attractive candidate for a loan. Conversely, erratic finances suggest a more cautious, cash-first approach may be necessary to avoid overextending the company. According to a recent report from the U.S. Chamber of Commerce, while 74% of small businesses feel comfortable with their cash flow, the number who feel very comfortable has been declining, highlighting the need for careful financial assessment.

Market Factors and Business Landscape

No business operates in a vacuum. The external environment plays a significant role in financing decisions. Consider the current economic climate and prevailing interest rates. In a low-rate environment, debt financing becomes more attractive. You must also analyze your competitive landscape. If a rival is making a significant move, you may need to accelerate your own growth plans with a loan to maintain your market position.

Option 1: Strategically Leveraging Existing Cash for Growth

Using your own cash—retained earnings—to fund growth is often seen as the safest route. It’s the embodiment of fiscal prudence, but it comes with its own set of strategic trade-offs.

Advantages of a Cash-First Growth Strategy

The most significant advantage of using cash is avoiding debt. This means no interest payments, no loan covenants restricting your business decisions, and no external stakeholder to answer to. You maintain 100% control and ownership of your company. This approach builds a resilient business with a strong balance sheet, which can be a major asset during economic downturns. It simplifies your finances and keeps operating expenses lower.

When to Deploy Cash for Maximum Impact

A cash-based approach is ideal for specific scenarios. It works best for funding initiatives with a clear, short-term return, such as a small-scale digital marketing campaign or a minor inventory increase for a predictable seasonal spike. It is also well-suited for covering incremental increases in operating expenses associated with gradual expansion. Using cash allows you to test new ideas and strategies on a smaller scale without taking on significant financial risk.

Risks and Considerations of a Cash-Based Approach

The primary risk of relying solely on cash is the potential for slow growth. You are limited by the rate at which you can generate and save profits. This conservative pace might cause you to miss out on significant market opportunities that require a larger, immediate capital injection. Furthermore, depleting your cash reserves for a growth project can leave your business vulnerable to unexpected expenses or a sudden drop in revenue, jeopardizing your day-to-day operational stability.

Option 2: Strategic Debt Financing for Accelerated Growth

Debt financing, in the form of business loans, is a powerful tool designed to accelerate growth beyond what retained earnings can support. It involves borrowing capital that you agree to pay back over a set period, with interest.

Advantages of Leveraging Loans for Expansion

The core benefit of a loan is speed. It provides immediate access to a significant amount of capital, enabling you to execute large-scale projects like a major equipment purchase, a facility expansion, or a significant marketing blitz. This financial leverage can generate returns that far exceed the cost of interest, amplifying your growth potential. Taking on and successfully managing debt can also build your business's credit history, making it easier to secure financing in the future.

Understanding Different Types of Debt Financing

Debt financing is not a one-size-fits-all solution. Several options exist, each tailored to different business needs:

Term Loans: A lump sum of capital paid back in regular installments over a fixed period. These are ideal for large, one-time investments like purchasing equipment or real estate.

Lines of Credit: A flexible form of credit that allows you to draw funds as needed up to a certain limit. This is perfect for managing cash flow fluctuations or covering ongoing operating expenses during an expansion phase.

SBA Loans: Government-backed loans with favorable terms, designed to support small businesses.

Key Considerations and Preparation for Debt Financing

Securing a loan requires thorough preparation. Lenders will scrutinize your business plan, financial statements, credit history, and cash flow projections. A significant challenge for many is the application process itself. In fact, some data indicates that 44% of SMBs avoided applying for a loan out of fear they wouldn't qualify. It’s crucial to have your finances in order and to clearly articulate how the borrowed capital will be used to generate growth and ensure repayment.

The Strategic Decision Framework: Making the Informed Choice

With a clear understanding of both options, you can now apply a structured framework to determine the best path for your business.

Step 1: Assess Your "Why" and "How Much"

Revisit your growth objectives. Is the opportunity time-sensitive, requiring immediate action? Or is it a gradual, long-term goal? Quantify the exact amount of capital needed. A small, incremental investment points toward cash, while a large capital expenditure for equipment or expansion often necessitates a loan.

Step 2: Evaluate Your Internal Cash Position and Capacity

Look at your cash reserves and projected cash flow. How much can you afford to allocate to a growth project without compromising your operational stability? Could you cover three to six months of operating expenses if your cash were tied up? If your internal capacity is limited, a loan becomes a more viable option. This hesitancy is common; in 2023, many business owners planned to use personal savings or credit cards before turning to bank loans.

Step 3: Analyze the External Financing Landscape

Research the current lending environment. What are the prevailing interest rates for term loans? What are the qualification requirements? The rise of non-bank lenders has expanded options for business owners. In late 2024, 76% of small business owners who applied for funding chose a non-bank lender, indicating a significant shift in the market. Explore these alternatives to find the most favorable terms for your company.

Step 4: Risk Assessment and Mitigation

Compare the risks of each approach. The risk of using cash is slower growth and depleted reserves. The risk of debt financing is the burden of repayment, especially if the investment doesn't yield the expected returns. Develop a mitigation plan. For a loan, this means creating conservative revenue projections to ensure you can comfortably make payments even in a downside scenario.

Step 5: Decision & Implementation

After weighing these factors, make your decision. Whether you choose cash, a loan, or a combination, create a detailed implementation plan. Track your spending, monitor the project's performance, and measure the return on your investment to ensure the chosen strategy is delivering the desired business growth.

Synergistic Strategies: When Cash and Loans Work Hand-in-Hand

The choice between cash and loans is not always mutually exclusive. The most sophisticated growth strategies often involve a hybrid approach, blending the stability of internal capital with the accelerating power of debt.

Blending Capital for Optimal Growth

A synergistic strategy leverages the strengths of both financing methods. For example, a business might use its own cash to make a down payment on a major piece of equipment, thereby reducing the total loan amount and lowering interest payments. This demonstrates financial commitment to lenders while preserving enough cash for working capital.

Strategic Uses: Short-term Working Capital vs. Long-term Growth

This blended approach allows for strategic allocation. You can use a flexible line of credit to manage short-term needs like inventory fluctuations or covering payroll during a seasonal dip. Simultaneously, you can use your retained earnings to self-fund smaller, long-term initiatives like software upgrades or employee training, reserving larger term loans for transformative expansion projects.

The Role of Strong Financial Institutions and Advisor Relationships

Building a strong relationship with a bank or financial advisor is crucial for implementing a successful hybrid strategy. They can provide valuable guidance on structuring your finances, identifying the right loan products, and timing your capital requests. A trusted advisor can help you see the bigger picture, ensuring your short-term financing decisions align with your long-term vision for business growth.

Long-Term Financial Health and Continuous Evaluation

Securing capital is just the beginning. The ultimate goal is to foster sustainable growth that enhances, rather than compromises, your company's long-term financial health. This requires ongoing vigilance and a willingness to adapt your strategy.

Monitoring Performance and Adjusting Strategies

Once a growth initiative is funded, you must meticulously track its performance against the initial projections. Are the new marketing efforts increasing customer acquisition? Is the new equipment boosting production efficiency? If results are falling short, be prepared to adjust your strategy quickly. Continuous evaluation ensures that your capital is always working as effectively as possible.

The Importance of Prudent Debt Management

If you have taken on debt, managing it prudently is paramount. This means making all payments on time, every time, to maintain a strong credit profile. It also involves regularly reviewing your debt structure. As your business grows and its finances strengthen, you may be able to refinance existing loans at better interest rates, freeing up cash flow for further investment.

Conclusion

The decision between using cash or securing a loan is one of the most critical strategic choices a business owner will make. There is no single right answer, only the right answer for your specific company at this specific moment. The optimal path is not found in a simple formula but through a disciplined, strategic framework. By clearly defining your growth objectives, honestly assessing your financial health, analyzing the market, and carefully weighing the risks, you can move beyond uncertainty. Whether you choose the stability of cash, the velocity of a loan, or a synergistic blend of both, an informed decision empowers you to fuel faster, smarter, and more sustainable business growth, turning your ambitions into tangible success.

Apply for a business loan today and see how BOSS can help you grow faster—with expert coaching to guide you every step of the way.